How do I request to add funds to my IRA? Please contact your ETZ representative who can facilitate.

Are there any tax benefits of having an (ETZ) account? In the general sense, yes. SEP IRA’s are tax deferred. All trading done within the IRA is tax free. Please consult with a tax professional or financial advisor for any related tax questions.

Will there be penalties or taxes when transferring my IRA/401K? There are no penalties incurred for direct transfers or rollovers.

Can I make a contribution to an IRA with digital assets I already own? No. Any contribution to your SEP IRA must be cash.

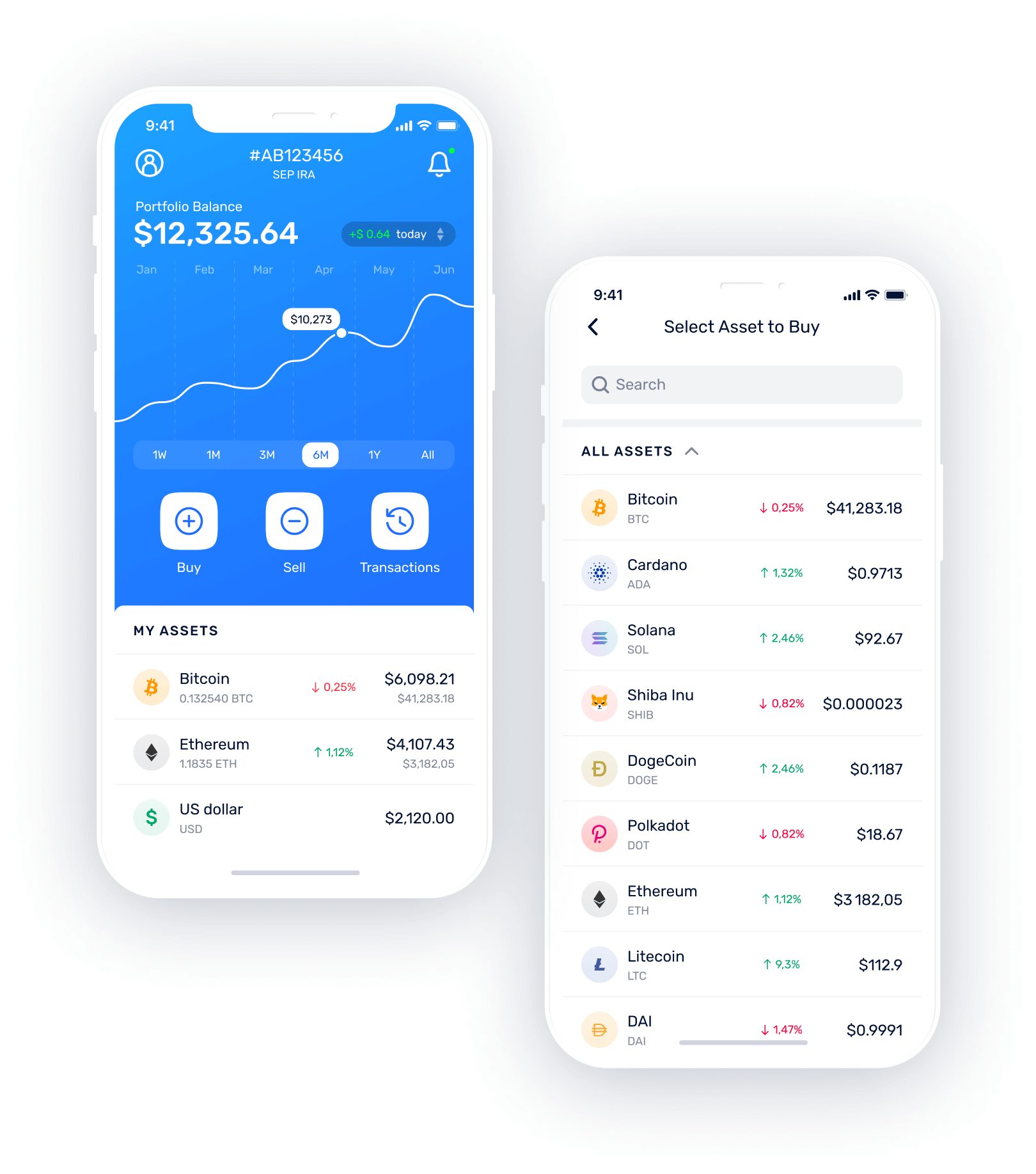

After my account gets funded, does it start as digital assets or USD? Your account will be funded in USD. You can trade your USD through our mobile app 24/7.

How can I fund my (ETZ) IRA? You can fund your SEP IRA via a contribution, or by rolling over funds from a previous retirement account. Please give us a call to discuss your options as the employer.

How are my investments secured? We provide institutional grade storage trusted by the largest institutions in the country. - The Digital Asset Vault is fully isolated in its own environment with strict access controls requiring 2FA for all staff

- 24/7 security monitoring of all Vault-related locations

- Recovery keys are stored offline and wallet key shares are encrypted at rest

- No single point of failure

- Secure air gapped recovery key

How long will it take to fund my (ETZ) IRA? You can fund your account same day. Once the account is approved/established, you’ll receive contribution forms with funding instructions.