Powered by Coinbase

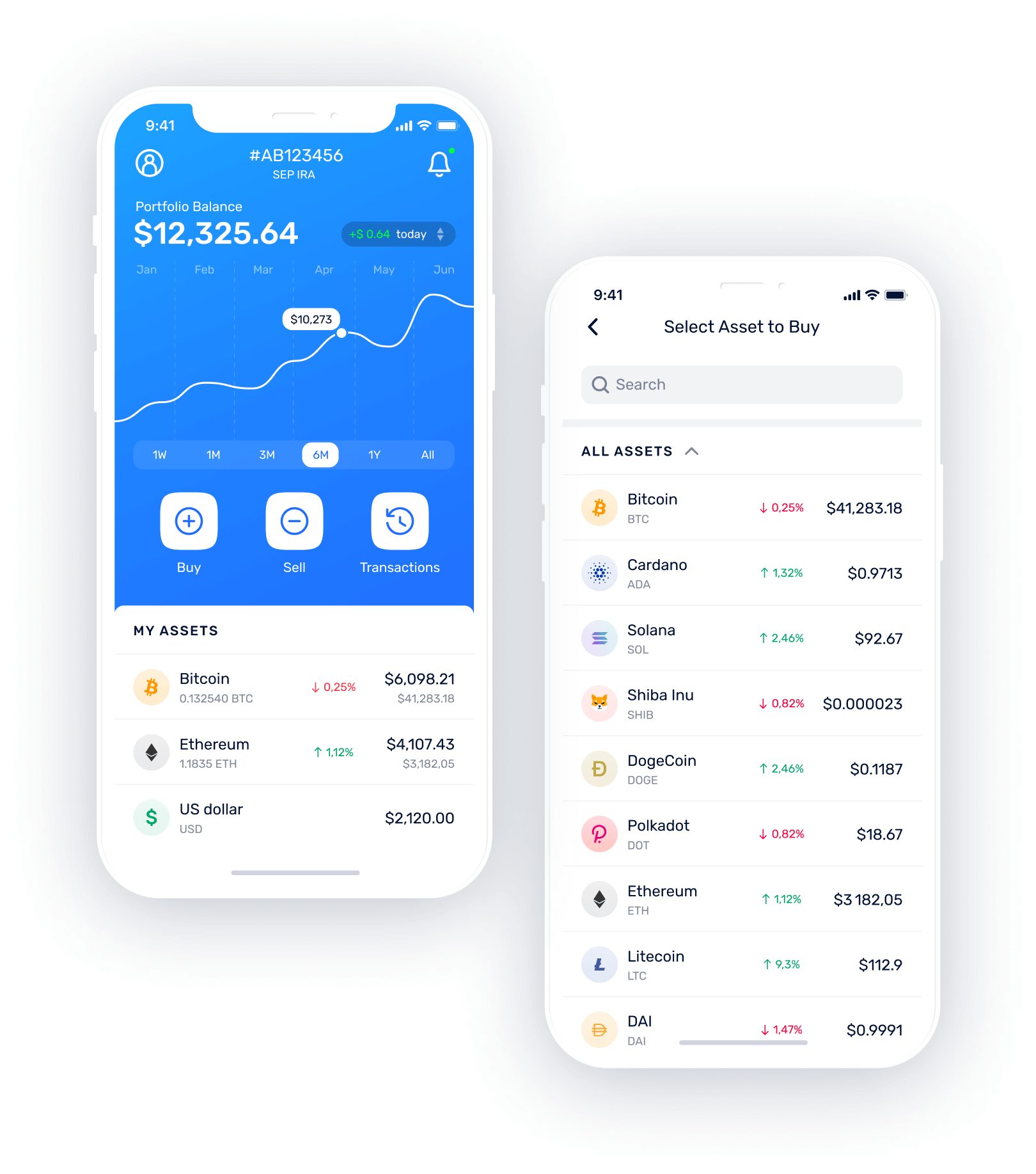

Powered by Coinbase Empower your employees with a digital assets SEP IRA A white glove digital assets retirement service for your business. We offer institutional-grade digital assets custody on your digital assets all while charging low transparent fees. Have an IRA or 401k you’d like to rollover? We can help with that as well. Download the App to Get Started